16th February 2017

The growth of the buy-to-let market isn’t slowing down, as the housing shortage in the UK continues. Because of this, you now see a lot of information out there to help landlords get the best rental yields for their properties, but interestingly there is less information on capital appreciation. More associated with buyers and vendors, capital appreciation is also a factor that landlords need to consider when they invest in property, now more than ever.

What is capital appreciation?

In comparison to cash flow, which is money that goes straight into your back pocket, capital appreciation is the profit made on an asset that has not yet been liquidated. Many investors use property for appreciation due to being one of the more reliable assets.

Investing in private rental properties is more often than not a longer-term commitment compared to refurbishment projects and other types of property investment. Therefore, it’s in a landlord’s best interest to look into the capital appreciation potential of a property for when they or their successor eventually sells them. It’s not worth investing in a rental property only to lose capital once you leave the sector.

Why should you think about capital appreciation?

If you’re looking to boost your personal income – maybe you’d like to add more to the retirement fund or raise more money to help out family - then it would be wise to consider capital appreciation opportunities.

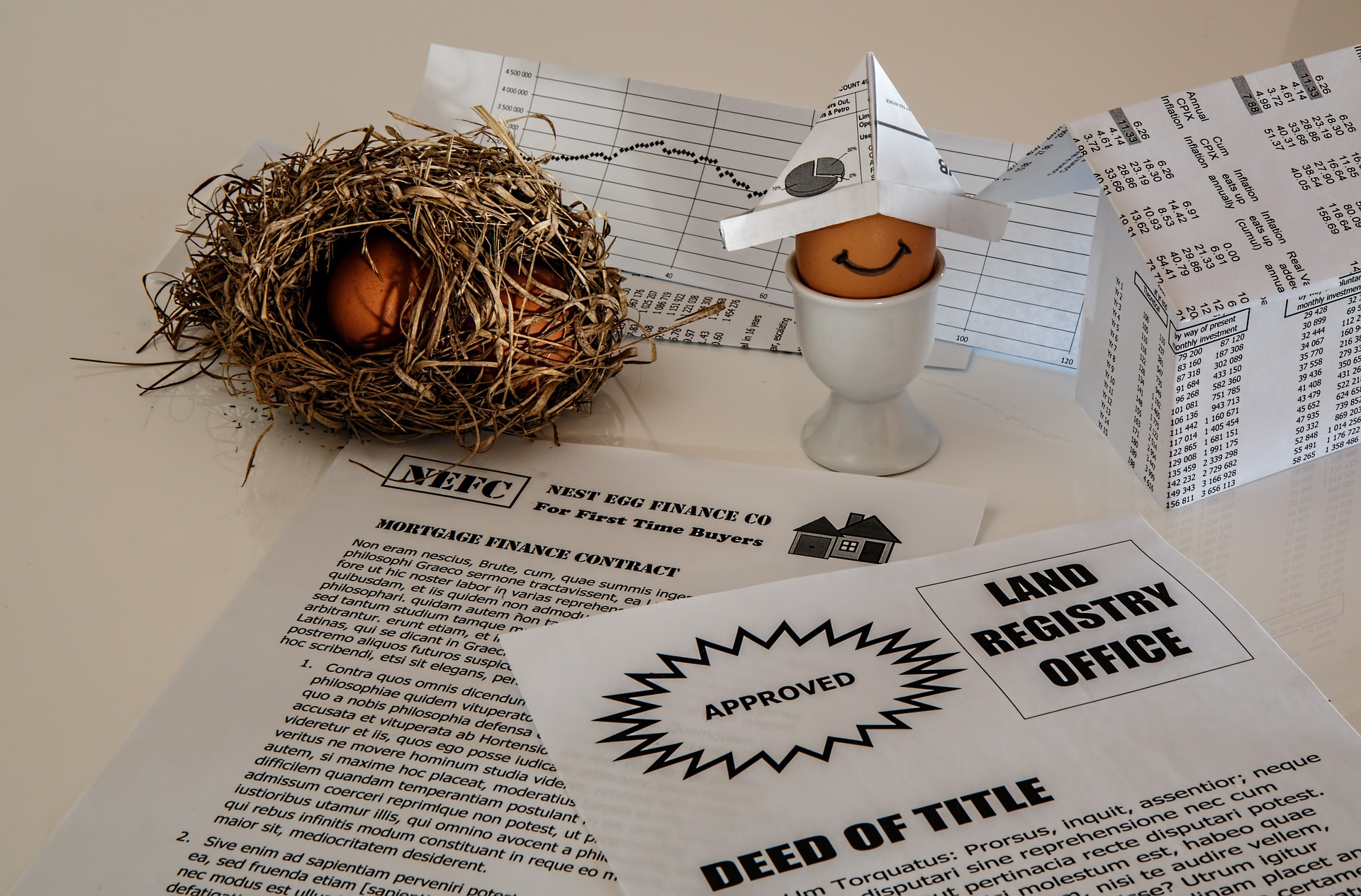

Once you reach pension age, you could stand to have a good nest egg to fall back on, especially since properties in the UK are increasing on average by 24% in value over 10 years.

Things to consider for capital appreciation

1) Buy an asset you can actually liquidate. It’s okay investing in properties to create some steady cash flow, but if the property is difficult to sell or in a poor location, then you could end up losing more capital than you earned overall. This is called capital depreciation. Look for properties in up and coming areas or areas going through regeneration. According to statistics, you could stand to gain up to 25% in value on a property over just 5 years if a new supermarket is built in the area.

2) Budget correctly and be aware of your net income. Only invest in properties you can genuinely afford – this includes décor and furnishing, maintenance and repairs, mortgage fees, taxation and utilities that match its size and build. The mortgage tax relief cuts introduced by the government last year only heighten the need for you to plan your budget carefully. Pushing yourself to invest in properties that generate a large gross income will end badly if you can’t manage the financial upkeep. You could end up cancelling out any rental yield you make for a number of years, but even worse, you could end up in debt with a need to liquidate quickly. You want capital appreciation to boost your income, not make up for your losses.

3) Be a good landlord. Don’t allow your property to become run-down and filled with bad tenants; it could influence the reputation its area has and thus decrease its market value. Looking after your tenants and ensuring a well-kempt property is heavily linked to how much the property will be worth over time.

If you’d like to focus on capital appreciation when making a buy-to-let investment, a consultation with a local property expert is highly recommended. Many of our local Concentric branches offer buy-to-let advisory workshops, where you can get advice and guidance tailored specifically to you. Click HERE to find out more.