What is an EPC and how do I read it?

Energy Performance Certificates (EPCs) were introduced in 2007 to give buyers a better understanding of the energy efficiency of a property they may wish to buy. The EPC is a legal requirement if you are selling or renting a property and are valid for 10 years from date of issue.

An EPC document includes an assessment of the current energy performance and estimated energy costs of the property as well as its potential future energy efficiency, if you were to implement the recommendations in the report.

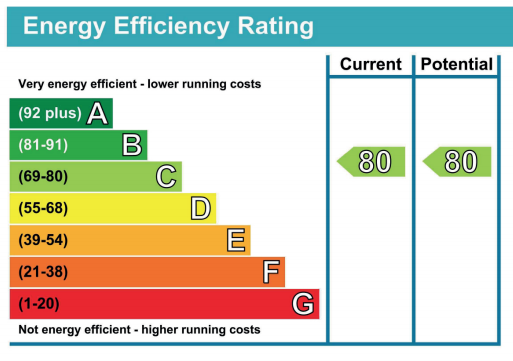

1.The EPC rating graphic

The ratings graphic shows how efficient your property is on a scale from A (very energy efficient to G (not very efficient). The higher the rating, the lower your potential energy costs will be.

Each letter is also assigned to a group of numbers (from 1 to 100). The higher up the scale, the better the property's efficiency. The first of two arrows shows the propertys current rating, whilst the second highlights the property’s potential rating if more energy-efficient features were to be installed.

The average EPC rating for a home in the UK is D.

The report goes on to details the changes you could make to improve the energy efficiency of the property, as well as detailing the estimated costs and potential savings you could make.

Who needs an EPC?

Sellers : It's a legal requirement to have an EPC for your home, before you sell it. You can arrange it through your Estate Agent, or directly with an EPC provider. The EPC register lists approved providers: https://www.epcregister.com/

Buyers. You should receive a copy of the EPC from the seller. Which you can use to plan energy efficiency improvements to the property or to negotiate the property price you pay.

Landlords. It is a legal requirement for buy-to-let properties to have an energy efficiency rating of E or above, before you can take on a new tenant or renew an existing contract. Later this year the rule will apply to existing tenancy agreements too.

Tenants. You should receive a copy of the EPC for the property you are renting. It will help you plan and budget for energy costs.

How can you improve the energy efficiency of your home?

- Insulate your floors, roof, loft and walls. Good quality insulation reduces the need for heating, which in turn reduces your energy consumption.

- Double glazing: heat is rapidly lost through single glazed windows. Double-glaze them to reduce your energy consumption.

- Solar panels: the cost for these is reducing and they can provide cheaper, greener energy.

- Low-energy lighting: low cost and easy to install, with no structural alterations required, low-energy light bulbs is a cheap, easy way to lower your energy bills.