23rd February 2017

If you're a landlord in Wolverhampton today, you might feel a little bruised by the assault made on your wallet after being (and continuing to be) ransacked over the last 12 months by HM Treasury’s tax changes on buy to let. To add insult to injury, Brexit has caused a tempering of the Wolverhampton property market, with property prices not increasing by the levels we have seen in the last few years. This means we might even see a very slight drop in property prices this year and, if Wolverhampton property prices do drop, the downside to that is that first time buyers could be attracted back into the Wolverhampton property market; meaning less demand for renting (meaning rents will go down).

Before we all run for the hills, all these things could be serendipitous to every Wolverhampton landlord - almost a blessing in disguise.

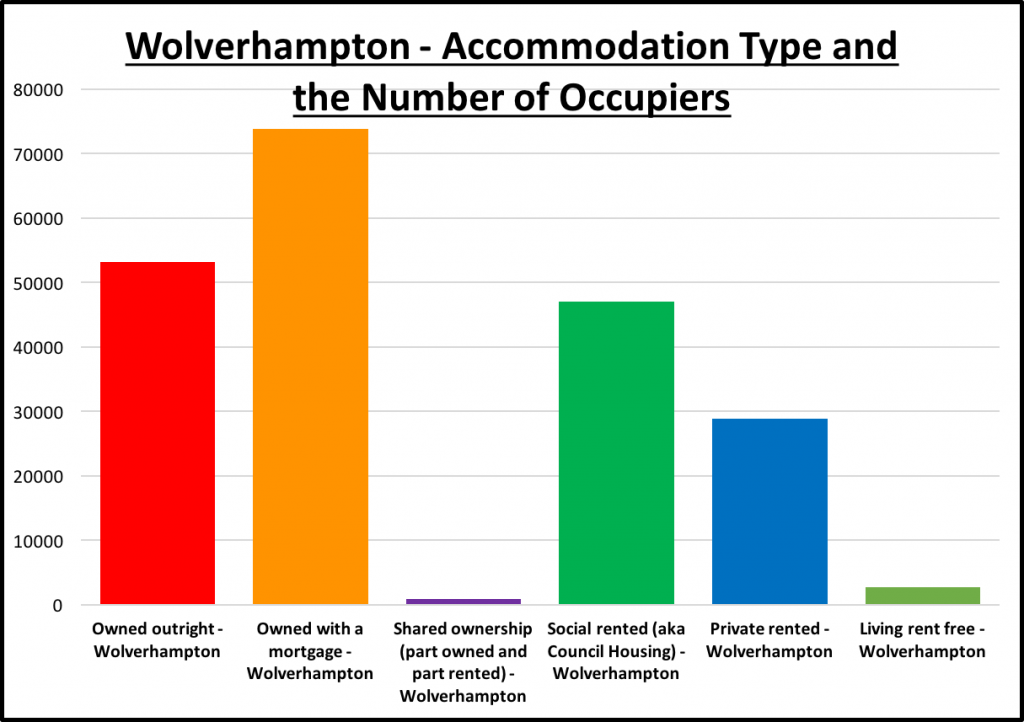

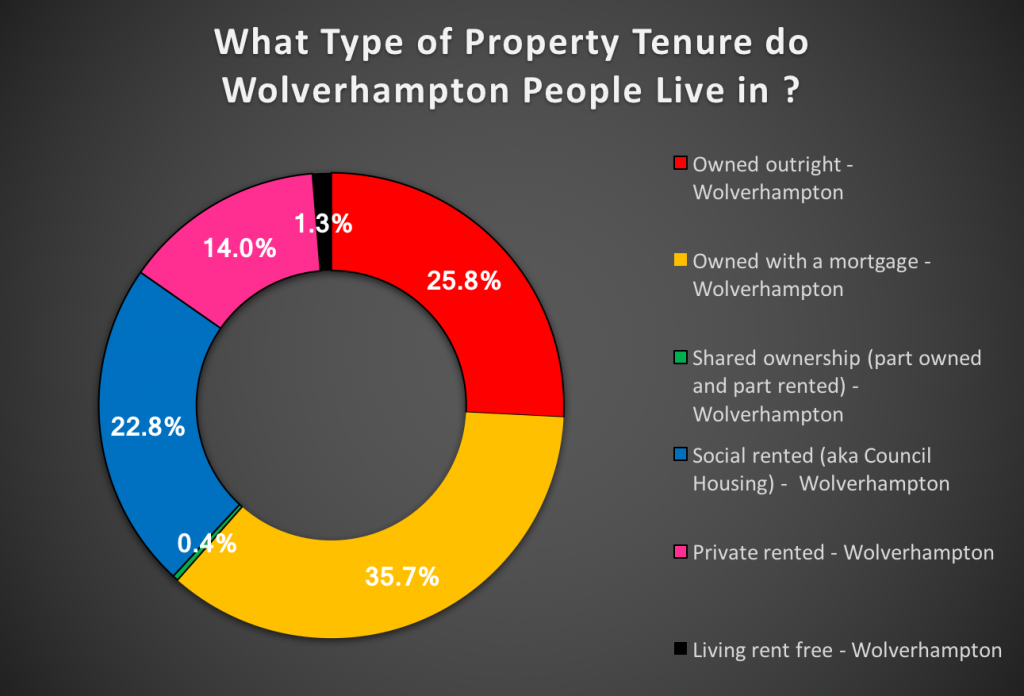

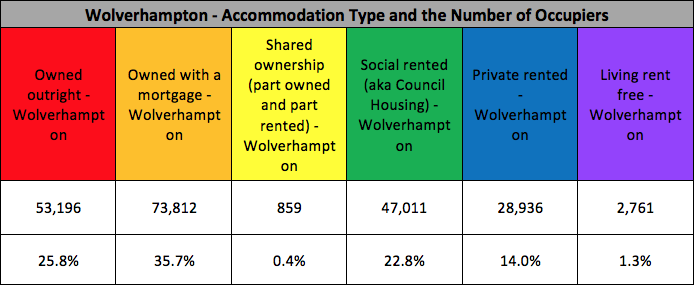

Wolverhampton has a population of 206,575, so when I looked at the number of people who lived in private rented accommodation, the numbers astounded me …

Yields will rise if Wolverhampton property prices fall, which will also make it easier to obtain a buy to let mortgage, as the income would cover more of the interest cost. If property values were to level off or come down, that could help Wolverhampton landlords add to their portfolio. Rental demand in Wolverhampton is expected to stay solid and may even see an improvement if uncertainty is protracted. However, there is something even more important that Wolverhampton landlords should be aware of: the change in the anthropological nature of these 20-something potential first time buyers.

Imagine the scenario of a young couple: both are in their mid/late twenties, both have decent jobs in Wolverhampton and they rent. The likelihood is they are planning to rent for the foreseeable future with no plans to even save for a deposit, let alone buy a property... but why aren’t they planning to buy?

Simply put, they don’t want to put cash into property. They would rather spend it on living and socialising by going on nice holidays and buying the latest tech and gadgets. They want the flexibility to live where they choose and finally, they don’t like the idea of paying for repairs.

So, as 14% of Wolverhampton people are in rented accommodation and as that figure is set to grow over the next decade, now might just be a good time to buy property in Wolverhampton – because what else are you going to invest in? At least with property, it’s something you can touch – there is nothing like bricks and mortar!